Steps to Profitability Blueprint

This tutorial is going to cover what I view as crucial steps to my own profitability. If any step is ignored it would result in a domino effect where profitability would be affected. When you enter an arena where about 90% of the players donate money to the profitable 10%, you need a strong defence and a stronger psychology.

Step 1a - The Market Trend

Market Trend - Trade in the direction of the overall markets.

Be aware of where you are in the overall market trend. "Retrace to mean" "Two standard deviations extended"

I created the Index Trend Model and the 350 trend model for my own market timing.

Markets do three things - 1, Trend Up. 2, Range (Trade in a range) 3, Trend Down

Step 1b - Stock Trends

This is the pool from which you will find your trade ideas. Align your trade ideas with the trend of the markets. It is our job to find trade ideas that should rise to the surface even in a bad market environment. Out perform the market. Now if the tide is clearly going out even the best ideas will probably struggle. The worst idea's will eat away at any profit the best ideas make. This is a game of two steps forward and one step back in a good market period trading with the tide on your side. Don't make things harder than they need to be. Being contrarian on top quality blue chip dividend stocks has its merits on a pension time frame but that is not our goal on a short to mid term approach. We need our account balance available for the best ideas that are moving up now. Trend fighting will test the limits of your trading psychology in a bad way.

*If the market is trending up then focus on only the best reward to risk long trades coming out of bases to maximize the available rewards. Do Not Chase.

*If the market is ranging be aware your long trend trade might have its limits. Focus new ideas on reward to risk within the parameters of a measured move of a base.

*If the market is trending down then you should be in cash when your last trailing stop is hit. Go on holiday. "Do Not Give Back Profits from the Bull Market to the Bear"

Filter your universe of stocks so you can only see the trending bulls or emerging bulls. Ignore the rest. The leading stocks are the easiest to find and the easiest to hold as they trend smoothly. Filtering trends in markets, sectors and stocks gives you an unrivalled market feel. You will soon become aware that what you are seeing in your filters is what is happening now and last week's filters are writing this week's news stories.

Lose The Blinkers. Many people are drawn to the markets by the volatile moves made in small caps. Oil & gas and miners being the favourites. With wide spreads, huge slippage and massive gap risks from share placings and bad news reports this end of the market is the hardest area to try and get some consistency out of your trading.

Many newcomers and even some more experienced investors don't realise that if you position size correctly the price of the share becomes irrelevant. Limiting your pool of shares you are willing to trade down to miners and oil and gas will only give you pockets of opportunity with huge account volatility. If you are screening the market trends you will start to get a feel for sector rotation and will be able to position in sectors ready or starting to move at the early stage of the trend where the risk is at its lowest. You will also notice that the leaders are higher priced shares. The small cap laggards that move later can have a smaller but more volatile window of opportunity.

Step 2 - Dedicate Time to a Routine

Create your own daily routine starting with the Index Trend and then moving into your stock screens to find ideas that are setting up in the direction of the underlying major trend. Set watch lists for bases so you can easily screen them daily. Print out your daily routine and pin it above your desk so you are totally in tune with the markets.

You will develop a market feel over time. This is an instinct that can only be achieved through time and routine.

Negatives & Excuses

Do Not Get Lost In Stories - Cut out all the media noise. They are NOT profitable traders. If you wait for a story to tell you when to buy you will miss every move. You will usually be entering when reward to risk is at its worst.

Do Not Waste Time Pumping Your Holding - It won't influence your P&L or win rate one bit. You don't need anyone to agree with your trade idea to make money. In fact the more people who disagree with you the higher the probabilities are that you are doing something right.

Do Not Look For Reasons To Hold Your Loser - You get paid by price and price alone. If you go looking for a reason to hold a loser you "WILL" find one.

Do Not Blame the Market Maker, The Stop Loss, The Broker or even Brexit..... The List Goes On & On. Losers are part of the plan. We will plan ahead so even if half of our trades are losers we can still make money and compound returns.

Dedicate Your Time to Finding Winners (not watching losers)

The best traders in the history of trading all had losers and on average were right between 40 & 60% of the time.

Don't waste your time trying to curve fit your trading to eliminate losers. Its impossible.

You get paid for your time when you find winners. A stop loss will look after the losers for you. Spend your time finding winners and honing your money management skills.

Losers should be deleted from any watch list's as soon as they hit the stop order.

A stop order is a sell order placed in the market where you want to sell your position be it to limit a loss or to lock in a profit. It does exactly what it says on the tin.

It sells your position when price moves below the price you specified. There is no "stops don't work" argument.

Step 3 - Money Management

This is what Trading Bases is all about. Risk & Money Management Techniques.

Let's break this down further.

*Risk of Ruin (Protect Yourself from the Market) - Protecting Yourself from Black Swans This is your first risk management goal that should override all others.

*Position Sizing (Protect Yourself from your own greed or over confidence) Position Sizing Versus Trading Psychology

*Heat & Losing Streaks (Protect Yourself from overexposure and a string of losers) Build Yourself a Robust Trading Plan

Once you decide the percent risk per trade you must stick with it and let compounding work. Don't start too big then blow your whole plan after the first string of losers.

If you think you're comfortable trading 1% risk per trade then half it before you start (you can scale up later) If you think you're comfortable trading 1/2% risk then half it and start on 1/4% risk. It's not about the money. It's about sticking to the process. Letting the compounding work. When that string of losers comes along you won't be able to pull the trigger on the next setup if you're trading your feel good risk amount. The only way you can build the mental strength needed to trade through drawdowns is to start off small so mistakes are limited and you have the psychology to trade your plan like a robot when times feel really bad.

Step 4 - Positive Expectancy

Before trading your systematic approach live with real money you must first prove your method has a positive expectancy.

*Back Test Your Approach - Load setup parameters into a spread sheet to calculate position sizing and reward to risk, profit taking or stop trailing results.

*Forward Test Your Approach - Trade your best back tested approach in real time. Does it give a reasonable expectancy reward? Do you get enough opportunities?

*Forward Test Your Approach on a Demo Account - Working with orders in real time can be a juggling act. You will make mistakes. It happens. Slippage is part of the process. Learn to work with what the market throws at you. Trading a demo has nothing to do with the psychology of trading. It's about the mechanics of executing trades. Don't underestimate how important the execution of your trading idea is. Bad execution can turn a 3 to 1 reward to risk trade into a 1 to 1 chased entry.

Step 5 - Reward to Risk

In my view this is the key to the whole puzzle. Positioning yourself in reward to risk trades where the risk is 1 but the available reward is 2 or more. When you combine this with a line in the sand defined setup it's a very powerful combination. Remember the best are right about 60% of the time though some of the best traders in history were only right around 40% of the time. How much money you make is down to your winners minus your losers. The quote "But I'm a long term investor" does not change this mathematical equation. Warren Buffet had huge winners and small losers. "He Had Losers". Refusing to have losers in a game where you will be right maybe half of the time is the biggest reason people average themselves down into a portfolio full of losers and turn their investing into pure gambling.

How Do You Know the Reward to Risk of Your Swing Trade Idea?

The reward to risk for a swing trade is very easy to calculate. If I'm trading a break of a consolidation (base) then I will simply measure the depth of the pattern and add it to the breakout level to give a measured move. This is the high probability move. If I load all my trades so they will return between 2 or 3 times my risk using the measured move as a target limit for the trade I will be profitable with a win rate between about 27 & 35% (including a bit of slippage & fees) Note you always have an option of holding these trades for much bigger gains. You might be an investor who likes to enter a position as a swing and let 2/3rds run as an investment that can be added to again later on a second entry setup.

How Do You Know the Reward to Risk of Your Trend Following or Investment Idea?

With longer term trading approaches the reward to risk on your idea can be unknown. The reward could be based on fundamental beliefs or on a technical break out but if you are shooting for bigger moves there is no high probability target area. This is where let your winners run and cut your losers short really comes into play. To skew the reward to risk in your favour you can start with wide trade parameters and as the idea moves in your favour you can tighten the parameters and build reward to risk into the trade or investment by adding to it. You can actually add to a trade and lower the risk at the same time. This is the exact opposite of averaging down which is widening your trade parameters and adding more risk.

Reward to Risk Becomes Dynamic as Price Moves in Your Favour

There is a trade off involved when you start to trail stops under winners. The tighter you trail a stop under price the more profit you will lock in but a tightly trailed stop will also knock you out of many winning trades early. If you don't trail your stop you won't be knocked out of any winners due to trailing too tightly but when your trade is up 2R and your target is 3R the reward to risk has flipped itself upside down. You are now risking 3R to make 1R. Taking this idea further if you have six trades running you will want to look at all trades together for the overall heat on your account. You could trail stops under previous lows on one trade and this will help offset risk on another trade thus freeing up account heat for another trade idea you want to take. It's really important to think in R multiples and not stare at the P&L all day.

Do Not Underestimate This Short Tutorial. Understand what you need to achieve just to be profitable. The Simple Guide to Risk Management. This gives a few examples of a group of trades that could happen in any market swing and highlights some bad habits that can destroy your expectancy.

Step 1a - The Market Trend

Market Trend - Trade in the direction of the overall markets.

Be aware of where you are in the overall market trend. "Retrace to mean" "Two standard deviations extended"

I created the Index Trend Model and the 350 trend model for my own market timing.

Markets do three things - 1, Trend Up. 2, Range (Trade in a range) 3, Trend Down

Step 1b - Stock Trends

This is the pool from which you will find your trade ideas. Align your trade ideas with the trend of the markets. It is our job to find trade ideas that should rise to the surface even in a bad market environment. Out perform the market. Now if the tide is clearly going out even the best ideas will probably struggle. The worst idea's will eat away at any profit the best ideas make. This is a game of two steps forward and one step back in a good market period trading with the tide on your side. Don't make things harder than they need to be. Being contrarian on top quality blue chip dividend stocks has its merits on a pension time frame but that is not our goal on a short to mid term approach. We need our account balance available for the best ideas that are moving up now. Trend fighting will test the limits of your trading psychology in a bad way.

*If the market is trending up then focus on only the best reward to risk long trades coming out of bases to maximize the available rewards. Do Not Chase.

*If the market is ranging be aware your long trend trade might have its limits. Focus new ideas on reward to risk within the parameters of a measured move of a base.

*If the market is trending down then you should be in cash when your last trailing stop is hit. Go on holiday. "Do Not Give Back Profits from the Bull Market to the Bear"

Filter your universe of stocks so you can only see the trending bulls or emerging bulls. Ignore the rest. The leading stocks are the easiest to find and the easiest to hold as they trend smoothly. Filtering trends in markets, sectors and stocks gives you an unrivalled market feel. You will soon become aware that what you are seeing in your filters is what is happening now and last week's filters are writing this week's news stories.

Lose The Blinkers. Many people are drawn to the markets by the volatile moves made in small caps. Oil & gas and miners being the favourites. With wide spreads, huge slippage and massive gap risks from share placings and bad news reports this end of the market is the hardest area to try and get some consistency out of your trading.

Many newcomers and even some more experienced investors don't realise that if you position size correctly the price of the share becomes irrelevant. Limiting your pool of shares you are willing to trade down to miners and oil and gas will only give you pockets of opportunity with huge account volatility. If you are screening the market trends you will start to get a feel for sector rotation and will be able to position in sectors ready or starting to move at the early stage of the trend where the risk is at its lowest. You will also notice that the leaders are higher priced shares. The small cap laggards that move later can have a smaller but more volatile window of opportunity.

Step 2 - Dedicate Time to a Routine

Create your own daily routine starting with the Index Trend and then moving into your stock screens to find ideas that are setting up in the direction of the underlying major trend. Set watch lists for bases so you can easily screen them daily. Print out your daily routine and pin it above your desk so you are totally in tune with the markets.

You will develop a market feel over time. This is an instinct that can only be achieved through time and routine.

Negatives & Excuses

Do Not Get Lost In Stories - Cut out all the media noise. They are NOT profitable traders. If you wait for a story to tell you when to buy you will miss every move. You will usually be entering when reward to risk is at its worst.

Do Not Waste Time Pumping Your Holding - It won't influence your P&L or win rate one bit. You don't need anyone to agree with your trade idea to make money. In fact the more people who disagree with you the higher the probabilities are that you are doing something right.

Do Not Look For Reasons To Hold Your Loser - You get paid by price and price alone. If you go looking for a reason to hold a loser you "WILL" find one.

Do Not Blame the Market Maker, The Stop Loss, The Broker or even Brexit..... The List Goes On & On. Losers are part of the plan. We will plan ahead so even if half of our trades are losers we can still make money and compound returns.

Dedicate Your Time to Finding Winners (not watching losers)

The best traders in the history of trading all had losers and on average were right between 40 & 60% of the time.

Don't waste your time trying to curve fit your trading to eliminate losers. Its impossible.

You get paid for your time when you find winners. A stop loss will look after the losers for you. Spend your time finding winners and honing your money management skills.

Losers should be deleted from any watch list's as soon as they hit the stop order.

A stop order is a sell order placed in the market where you want to sell your position be it to limit a loss or to lock in a profit. It does exactly what it says on the tin.

It sells your position when price moves below the price you specified. There is no "stops don't work" argument.

Step 3 - Money Management

This is what Trading Bases is all about. Risk & Money Management Techniques.

Let's break this down further.

*Risk of Ruin (Protect Yourself from the Market) - Protecting Yourself from Black Swans This is your first risk management goal that should override all others.

*Position Sizing (Protect Yourself from your own greed or over confidence) Position Sizing Versus Trading Psychology

*Heat & Losing Streaks (Protect Yourself from overexposure and a string of losers) Build Yourself a Robust Trading Plan

Once you decide the percent risk per trade you must stick with it and let compounding work. Don't start too big then blow your whole plan after the first string of losers.

If you think you're comfortable trading 1% risk per trade then half it before you start (you can scale up later) If you think you're comfortable trading 1/2% risk then half it and start on 1/4% risk. It's not about the money. It's about sticking to the process. Letting the compounding work. When that string of losers comes along you won't be able to pull the trigger on the next setup if you're trading your feel good risk amount. The only way you can build the mental strength needed to trade through drawdowns is to start off small so mistakes are limited and you have the psychology to trade your plan like a robot when times feel really bad.

Step 4 - Positive Expectancy

Before trading your systematic approach live with real money you must first prove your method has a positive expectancy.

*Back Test Your Approach - Load setup parameters into a spread sheet to calculate position sizing and reward to risk, profit taking or stop trailing results.

*Forward Test Your Approach - Trade your best back tested approach in real time. Does it give a reasonable expectancy reward? Do you get enough opportunities?

*Forward Test Your Approach on a Demo Account - Working with orders in real time can be a juggling act. You will make mistakes. It happens. Slippage is part of the process. Learn to work with what the market throws at you. Trading a demo has nothing to do with the psychology of trading. It's about the mechanics of executing trades. Don't underestimate how important the execution of your trading idea is. Bad execution can turn a 3 to 1 reward to risk trade into a 1 to 1 chased entry.

Step 5 - Reward to Risk

In my view this is the key to the whole puzzle. Positioning yourself in reward to risk trades where the risk is 1 but the available reward is 2 or more. When you combine this with a line in the sand defined setup it's a very powerful combination. Remember the best are right about 60% of the time though some of the best traders in history were only right around 40% of the time. How much money you make is down to your winners minus your losers. The quote "But I'm a long term investor" does not change this mathematical equation. Warren Buffet had huge winners and small losers. "He Had Losers". Refusing to have losers in a game where you will be right maybe half of the time is the biggest reason people average themselves down into a portfolio full of losers and turn their investing into pure gambling.

How Do You Know the Reward to Risk of Your Swing Trade Idea?

The reward to risk for a swing trade is very easy to calculate. If I'm trading a break of a consolidation (base) then I will simply measure the depth of the pattern and add it to the breakout level to give a measured move. This is the high probability move. If I load all my trades so they will return between 2 or 3 times my risk using the measured move as a target limit for the trade I will be profitable with a win rate between about 27 & 35% (including a bit of slippage & fees) Note you always have an option of holding these trades for much bigger gains. You might be an investor who likes to enter a position as a swing and let 2/3rds run as an investment that can be added to again later on a second entry setup.

How Do You Know the Reward to Risk of Your Trend Following or Investment Idea?

With longer term trading approaches the reward to risk on your idea can be unknown. The reward could be based on fundamental beliefs or on a technical break out but if you are shooting for bigger moves there is no high probability target area. This is where let your winners run and cut your losers short really comes into play. To skew the reward to risk in your favour you can start with wide trade parameters and as the idea moves in your favour you can tighten the parameters and build reward to risk into the trade or investment by adding to it. You can actually add to a trade and lower the risk at the same time. This is the exact opposite of averaging down which is widening your trade parameters and adding more risk.

Reward to Risk Becomes Dynamic as Price Moves in Your Favour

There is a trade off involved when you start to trail stops under winners. The tighter you trail a stop under price the more profit you will lock in but a tightly trailed stop will also knock you out of many winning trades early. If you don't trail your stop you won't be knocked out of any winners due to trailing too tightly but when your trade is up 2R and your target is 3R the reward to risk has flipped itself upside down. You are now risking 3R to make 1R. Taking this idea further if you have six trades running you will want to look at all trades together for the overall heat on your account. You could trail stops under previous lows on one trade and this will help offset risk on another trade thus freeing up account heat for another trade idea you want to take. It's really important to think in R multiples and not stare at the P&L all day.

Do Not Underestimate This Short Tutorial. Understand what you need to achieve just to be profitable. The Simple Guide to Risk Management. This gives a few examples of a group of trades that could happen in any market swing and highlights some bad habits that can destroy your expectancy.

Build Failure Into Your Trading

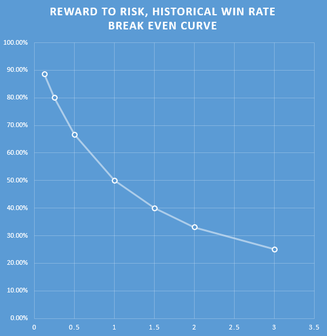

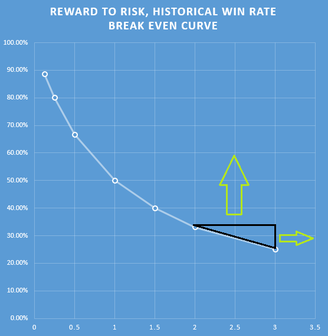

The charts above show the break even line by calculating the average R per trade against a historical win rate. If you are right 50% of the time and your average R per trade is 1 then on paper you are breaking even. In reality you are losing after trading costs. We need to build in a degree of failure during bad market periods into our approach up front. The chart on the right shows the measured move swing trade style I've written about in the members area.

I'm shooting for a reward to risk of 2 or 3 to 1 within the parameters of a high probability measured move. An achievable target. As you can see we need to be right between 27 and 35% (including slippage & trading costs) to break even. The black triangle highlights our entry zone parameters. The arrows show the potential upside.

*If you can be right around half of the time you will do very well indeed.

*If you hold some trades for multi R gains you will do even better.

*If you trail a stop to a half stop when your trade moves up maybe 1.5 to 2R you will skew the reward to risk in your favour even more.

*If you can add to winners on a second entry setup you will be getting the odd trade that lifts your account to a higher level.

Recap

Trade with the trend, Trade with the tide on your side, have a systematic routine, use your time positively, cut out all noise, own your mistakes, master money management techniques, prove your expectancy, be in total control of the reward to risk, trade a defined entry setup, execute your ideas with precision, don't chase a missed opportunity, think in R multiples and ignore the P&L swings.

I guarantee that the trader or investor who digs in and takes total control of these steps to profitability will come through the other side with a hugely reduced psychological barrier to risk and a strong defence. Both are crucial to be a successful trader or investor. There are no short cuts.

Next Tutorial - Trading Psychology of a Systematic Approach

@stealthsurf Jase

The charts above show the break even line by calculating the average R per trade against a historical win rate. If you are right 50% of the time and your average R per trade is 1 then on paper you are breaking even. In reality you are losing after trading costs. We need to build in a degree of failure during bad market periods into our approach up front. The chart on the right shows the measured move swing trade style I've written about in the members area.

I'm shooting for a reward to risk of 2 or 3 to 1 within the parameters of a high probability measured move. An achievable target. As you can see we need to be right between 27 and 35% (including slippage & trading costs) to break even. The black triangle highlights our entry zone parameters. The arrows show the potential upside.

*If you can be right around half of the time you will do very well indeed.

*If you hold some trades for multi R gains you will do even better.

*If you trail a stop to a half stop when your trade moves up maybe 1.5 to 2R you will skew the reward to risk in your favour even more.

*If you can add to winners on a second entry setup you will be getting the odd trade that lifts your account to a higher level.

Recap

Trade with the trend, Trade with the tide on your side, have a systematic routine, use your time positively, cut out all noise, own your mistakes, master money management techniques, prove your expectancy, be in total control of the reward to risk, trade a defined entry setup, execute your ideas with precision, don't chase a missed opportunity, think in R multiples and ignore the P&L swings.

I guarantee that the trader or investor who digs in and takes total control of these steps to profitability will come through the other side with a hugely reduced psychological barrier to risk and a strong defence. Both are crucial to be a successful trader or investor. There are no short cuts.

Next Tutorial - Trading Psychology of a Systematic Approach

@stealthsurf Jase