There is a cost to learning.

Before I move into the commission drag end of this tutorial I'm going to run through a few things that I would consider part of the cost of learning.

There is a cost of setting up and then there is a cost of running this business. There is also a very real cost of ignoring the most important part of investing of learning how to manage money by building a methodology around risk management before going live.

Time

Time will be the first investment. Its going to take time to build a methodology that you are happy with. It usually takes a couple of full market cycles to really be at one with your methodology. The market plays out on its own time frame. You cannot change this. Patience to let your methodology play out on the markets time frame is key.

Mentor / Methodology

Without any training or prior experience you can fund an account and compete with the best speculators in the world. It seems insane doesn't it.

Its amazing how we approach the markets wide eyed and confident thinking we can take on Mike Tyson with absolutely no training or experience.

Find a mentor. Learn how to protect the account. Get the risk management in place. Mould it into a methodology that suits you and your time available and also time frame. Learn about different methods. Investing would be years and is better suited to funds and quality dividend shares trading the big cycles. Trend following would be months to years if riding primary trends. Swing or momentum trading would be days to weeks riding the steps in the primary trend. I'm a believer in the mentor approach. Finding a good one is a minefield but you will fast track the learning curve if you find one that suits your own style and goals. You might not even know what your style is yet.

Hardware

We are running a business. I have an office and I have a dedicated desktop pc for my trading software. I like to keep it free of all the distractions of the internet. I like the feel of going to work. I'm not sat in front of the tv with a laptop on my knee. Total focus on the job in hand. The routine.

Software

Trading software can be expensive but good data is essential. I use Sharescope Pro as I'm at the pc in the day. Sharescope Plus is delayed and fine for end of day methods. The advantage of using quality software like ShareScope is the data mining feature lets me input my daily routine. This is a powerful tool and I can condense what would take hours into 10 minutes a day.

If you are thinking of trying out ShareScope You can use the Trading Bases ShareScope referral to get 1 month Free.Trading Resources

Commission

You will be charged a fee by your broker on every transaction. It could be a flat rate or it could be a percentage. There are trade offs here.

If you have a small account then a discount broker that charges a flat fee might make sense. If the discount broker gives bad execution it could be costing you way more in slippage than you save in commission. You could also find that an active methodology is basically too active for your account size and is causing huge commission drag even with the cheapest discount broker. Can year on year results realistically offset this? If you are getting results from your methodology and commission drag is the only problem you have then its easy to fix. Add more funds to the account. Its actually better to trade small while honing your methodology and slowly increase your available funds as you progress. Never throw good money after bad.

If your methodology requires taking very few trades because you are holding longer term trends or investments then good execution is going to be better and more than offset commission drag.

If your methodology has a higher turnover of positions or multiple entries, exits then a discount broker might suit but this depends on the size of your account. My personal view is large accounts are going to be better suited to execution over commission.

The bid-offer spread

The bid is the price the buyer is willing to buy and the offer is the price the seller is willing to sell. The cost to you is the difference.

If your methodology requires holding longer term trends or investments then wider spreads are not an issue. You will never look back on the entry of your best mover for the year and question whether getting a tighter spread or a better price at the cost of not getting filled on the trade is a good trade off.

If your methodology has a higher turnover of positions or multiple entries, exits then wide spread costs could start to eat into your results especially if you are shorter term swing trading. The smaller the move you are capturing the larger the negative affect of a wide spread will be.

I trade some illiquid names and the only time I don't get filled is when I use a limit order for tighter swing trades that are price critical for reward to risk reasons.

Now lets just clear this little myth up about there being more buyers than sellers and thus price should rise. To buy 100 shares someone needs to match your order and sell you 100 shares. There is someone on the other side of every transaction. You can place a buy order between the spread if you like on a limit or above the offer as a buy stop. Now what if people were prepared to buy all of their position at the offer price on a basic market order. Then price would fill that order where the shares are available and depending where you are in the queue. So at the end of the day buy pressure moves prices higher and sell pressure moves prices lower. Buyers prepared to buy the offer are overwhelming sellers prepared to sell the bid. Combine this with buy stops above and sell stops below.

Stamp Duty

Stamp duty is charged to buyers on many main market shares in the UK. No stamp duty is paid when you sell. There are exceptions on some shares like IPO's so check out the governments tax pages to learn more.

Capital Gains Tax

If you open an Individual Savings Account (ISA) you can contribute £20,000 (2018-18 tax year) so you don't have to pay CGT on profits made from rises in the price of shares.

Commission Drag

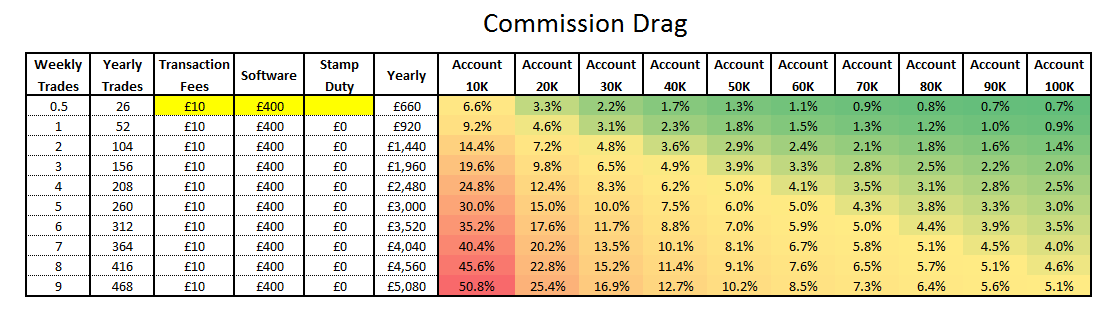

In the spreadsheet below I've punched in a basic transaction fee of £10. This is what my own broker charges. I've allowed £400 for the most basic charting package. The chart below shows the commission drag of these costs taking into account how many trades are executed on a weekly or monthly bases average and the yearly affect it has on different account sizes. Its very clear that active trading / investing or scaling in and out of positions is going to have an extremely high drag on small accounts. Small accounts are probably better suited trend following or true investing time frames if you want to keep your risk and total account heat low enough to survive the learning curve. The way I think of this is if I cannot make good returns taking 20 of my best ideas in a year then taking 50 or 100 won't change this. It will only magnify drag and maybe losses.

Before I move into the commission drag end of this tutorial I'm going to run through a few things that I would consider part of the cost of learning.

There is a cost of setting up and then there is a cost of running this business. There is also a very real cost of ignoring the most important part of investing of learning how to manage money by building a methodology around risk management before going live.

Time

Time will be the first investment. Its going to take time to build a methodology that you are happy with. It usually takes a couple of full market cycles to really be at one with your methodology. The market plays out on its own time frame. You cannot change this. Patience to let your methodology play out on the markets time frame is key.

Mentor / Methodology

Without any training or prior experience you can fund an account and compete with the best speculators in the world. It seems insane doesn't it.

Its amazing how we approach the markets wide eyed and confident thinking we can take on Mike Tyson with absolutely no training or experience.

Find a mentor. Learn how to protect the account. Get the risk management in place. Mould it into a methodology that suits you and your time available and also time frame. Learn about different methods. Investing would be years and is better suited to funds and quality dividend shares trading the big cycles. Trend following would be months to years if riding primary trends. Swing or momentum trading would be days to weeks riding the steps in the primary trend. I'm a believer in the mentor approach. Finding a good one is a minefield but you will fast track the learning curve if you find one that suits your own style and goals. You might not even know what your style is yet.

Hardware

We are running a business. I have an office and I have a dedicated desktop pc for my trading software. I like to keep it free of all the distractions of the internet. I like the feel of going to work. I'm not sat in front of the tv with a laptop on my knee. Total focus on the job in hand. The routine.

Software

Trading software can be expensive but good data is essential. I use Sharescope Pro as I'm at the pc in the day. Sharescope Plus is delayed and fine for end of day methods. The advantage of using quality software like ShareScope is the data mining feature lets me input my daily routine. This is a powerful tool and I can condense what would take hours into 10 minutes a day.

If you are thinking of trying out ShareScope You can use the Trading Bases ShareScope referral to get 1 month Free.Trading Resources

Commission

You will be charged a fee by your broker on every transaction. It could be a flat rate or it could be a percentage. There are trade offs here.

If you have a small account then a discount broker that charges a flat fee might make sense. If the discount broker gives bad execution it could be costing you way more in slippage than you save in commission. You could also find that an active methodology is basically too active for your account size and is causing huge commission drag even with the cheapest discount broker. Can year on year results realistically offset this? If you are getting results from your methodology and commission drag is the only problem you have then its easy to fix. Add more funds to the account. Its actually better to trade small while honing your methodology and slowly increase your available funds as you progress. Never throw good money after bad.

If your methodology requires taking very few trades because you are holding longer term trends or investments then good execution is going to be better and more than offset commission drag.

If your methodology has a higher turnover of positions or multiple entries, exits then a discount broker might suit but this depends on the size of your account. My personal view is large accounts are going to be better suited to execution over commission.

The bid-offer spread

The bid is the price the buyer is willing to buy and the offer is the price the seller is willing to sell. The cost to you is the difference.

If your methodology requires holding longer term trends or investments then wider spreads are not an issue. You will never look back on the entry of your best mover for the year and question whether getting a tighter spread or a better price at the cost of not getting filled on the trade is a good trade off.

If your methodology has a higher turnover of positions or multiple entries, exits then wide spread costs could start to eat into your results especially if you are shorter term swing trading. The smaller the move you are capturing the larger the negative affect of a wide spread will be.

I trade some illiquid names and the only time I don't get filled is when I use a limit order for tighter swing trades that are price critical for reward to risk reasons.

Now lets just clear this little myth up about there being more buyers than sellers and thus price should rise. To buy 100 shares someone needs to match your order and sell you 100 shares. There is someone on the other side of every transaction. You can place a buy order between the spread if you like on a limit or above the offer as a buy stop. Now what if people were prepared to buy all of their position at the offer price on a basic market order. Then price would fill that order where the shares are available and depending where you are in the queue. So at the end of the day buy pressure moves prices higher and sell pressure moves prices lower. Buyers prepared to buy the offer are overwhelming sellers prepared to sell the bid. Combine this with buy stops above and sell stops below.

Stamp Duty

Stamp duty is charged to buyers on many main market shares in the UK. No stamp duty is paid when you sell. There are exceptions on some shares like IPO's so check out the governments tax pages to learn more.

Capital Gains Tax

If you open an Individual Savings Account (ISA) you can contribute £20,000 (2018-18 tax year) so you don't have to pay CGT on profits made from rises in the price of shares.

Commission Drag

In the spreadsheet below I've punched in a basic transaction fee of £10. This is what my own broker charges. I've allowed £400 for the most basic charting package. The chart below shows the commission drag of these costs taking into account how many trades are executed on a weekly or monthly bases average and the yearly affect it has on different account sizes. Its very clear that active trading / investing or scaling in and out of positions is going to have an extremely high drag on small accounts. Small accounts are probably better suited trend following or true investing time frames if you want to keep your risk and total account heat low enough to survive the learning curve. The way I think of this is if I cannot make good returns taking 20 of my best ideas in a year then taking 50 or 100 won't change this. It will only magnify drag and maybe losses.

Account Size and the Pitfalls of Comparing Your Own Results With Others.

Are we here to invest for the future or have some fun gambling with spare income? You might be here to invest and could be following someone who has money to play with. His gambling account could be larger than your pension fund. Don't think that because someone is successful in other areas and talks a good talk that this will reflect the trading results they appear to be posting on social media.

The year was 2018. The markets sold off hard into the end of December and the performance updates from investors on social media come in thick and fast. @AIM_Cash_Machine had another fantastic year. He was up +40%. His profile says he's averaged this since 1982. He's outperformed the best investors of all time but he likes to keep his identity secret. He says he uses twitter as his trading journal.

Investor 1 has £1000 in a spread bet account and went all in one micro cap that turns out to be a good mover and is up a few hundred percent.

Investor 2 has a 20K concentrated small cap account and took 8 trades and is up 20%

Investor 3 has a 20K diversified account and took 200 trades and is up +40%

Investor 4 has a 500K diversified account and took 50 trades and is down -12%

Do you think investor 1 can replicate that all in bet on investor 2's account?

Do you think investor 2 can replicate that concentrated small cap methodology on investor 4's account?

Do you think investor 3 actually took 200 trades on a 20k account with a minimum of -7% commission drag and made +40% in a terrible year?

Do you think investor 4 can apply his 500K portfolio to Investor 1 or 2's genuine results?

The answer is clearly no.

Who would you choose to manage your money if you had to give it to one of these four and it was a meaningful amount that took you years to build up?

I think I would rather be down -12% on a terrible year knowing my money is in the hands of a good manager that built a sizable account over many years of sensible investing. My reply to those who tell you account size doesn't matter but percentage does would be nonsense. To think that a few grand in a spread bet account with +100% results compares with a small gain in a large account in insane.

So where am I going with this? You can spend your life chasing the golden carrot or you can be realistic about your own account size and investment goals.

Many risky trade approaches will be closed down due to liquidity, risk and psychological reasons as the account grows. The older you are the closer to retirement you get the lower your risk tolerance will naturally be.

To end this blog lets be realistic about the goals we have.

At the end of the day there are some unavoidable cost's to trading or investing and we need to consider how much drag a methodology can soak up without impacting performance too heavily. Its going to be personal to our own account size and time frame. Its something we can take control of as we develop a methodology and it could be the difference between profitable and repeatable or unprofitable due to the current size of the account.

Are we here to invest for the future or have some fun gambling with spare income? You might be here to invest and could be following someone who has money to play with. His gambling account could be larger than your pension fund. Don't think that because someone is successful in other areas and talks a good talk that this will reflect the trading results they appear to be posting on social media.

The year was 2018. The markets sold off hard into the end of December and the performance updates from investors on social media come in thick and fast. @AIM_Cash_Machine had another fantastic year. He was up +40%. His profile says he's averaged this since 1982. He's outperformed the best investors of all time but he likes to keep his identity secret. He says he uses twitter as his trading journal.

Investor 1 has £1000 in a spread bet account and went all in one micro cap that turns out to be a good mover and is up a few hundred percent.

Investor 2 has a 20K concentrated small cap account and took 8 trades and is up 20%

Investor 3 has a 20K diversified account and took 200 trades and is up +40%

Investor 4 has a 500K diversified account and took 50 trades and is down -12%

Do you think investor 1 can replicate that all in bet on investor 2's account?

Do you think investor 2 can replicate that concentrated small cap methodology on investor 4's account?

Do you think investor 3 actually took 200 trades on a 20k account with a minimum of -7% commission drag and made +40% in a terrible year?

Do you think investor 4 can apply his 500K portfolio to Investor 1 or 2's genuine results?

The answer is clearly no.

Who would you choose to manage your money if you had to give it to one of these four and it was a meaningful amount that took you years to build up?

I think I would rather be down -12% on a terrible year knowing my money is in the hands of a good manager that built a sizable account over many years of sensible investing. My reply to those who tell you account size doesn't matter but percentage does would be nonsense. To think that a few grand in a spread bet account with +100% results compares with a small gain in a large account in insane.

So where am I going with this? You can spend your life chasing the golden carrot or you can be realistic about your own account size and investment goals.

Many risky trade approaches will be closed down due to liquidity, risk and psychological reasons as the account grows. The older you are the closer to retirement you get the lower your risk tolerance will naturally be.

To end this blog lets be realistic about the goals we have.

At the end of the day there are some unavoidable cost's to trading or investing and we need to consider how much drag a methodology can soak up without impacting performance too heavily. Its going to be personal to our own account size and time frame. Its something we can take control of as we develop a methodology and it could be the difference between profitable and repeatable or unprofitable due to the current size of the account.

Jase @stealthsurf