The chat group offers all the benefits of trading alongside a group of experienced, like-minded investors in addition of your own personal market screening assistant to run through the end of day screening and compile a list of the best growth / value / swing or trend stocks. Sectors Ranks and updates on the current market and sector trends. I personally do 4 hours work every day to update the UK and US market screens that highlight the best growth, value and trend of the moment. I highlight all breakouts and pullbacks in stocks from a fundamental bottom-up perspective. I run through markets from a top-down perspective. These routines are performed every trading day in good times and bad.

UK end of day live screening sessions

I run through my end of day screening at 7pm UK time. This screening method will pull up every reversal from a pullback and will capture every future big winner. These stocks will all go through these screens multiple times on their journey. I'm screening for actionable ideas for the next day's market. Its crucial, whether you're an investor or trader, to understand the normal action of how stocks trade, as we need to size and manage positions efficiently. The sessions are interactive and can sometimes last until the US closing bell as we really enjoy them. They can also be viewed on playback through the link in the chatroom.

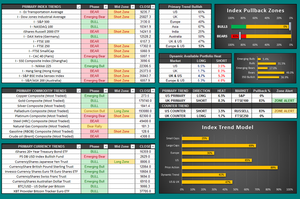

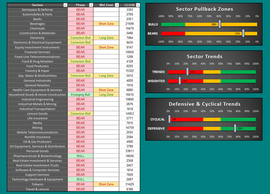

Top down market analysis trend models

Always stay on the right side of the markets by trading with the underlying market and sector trends.

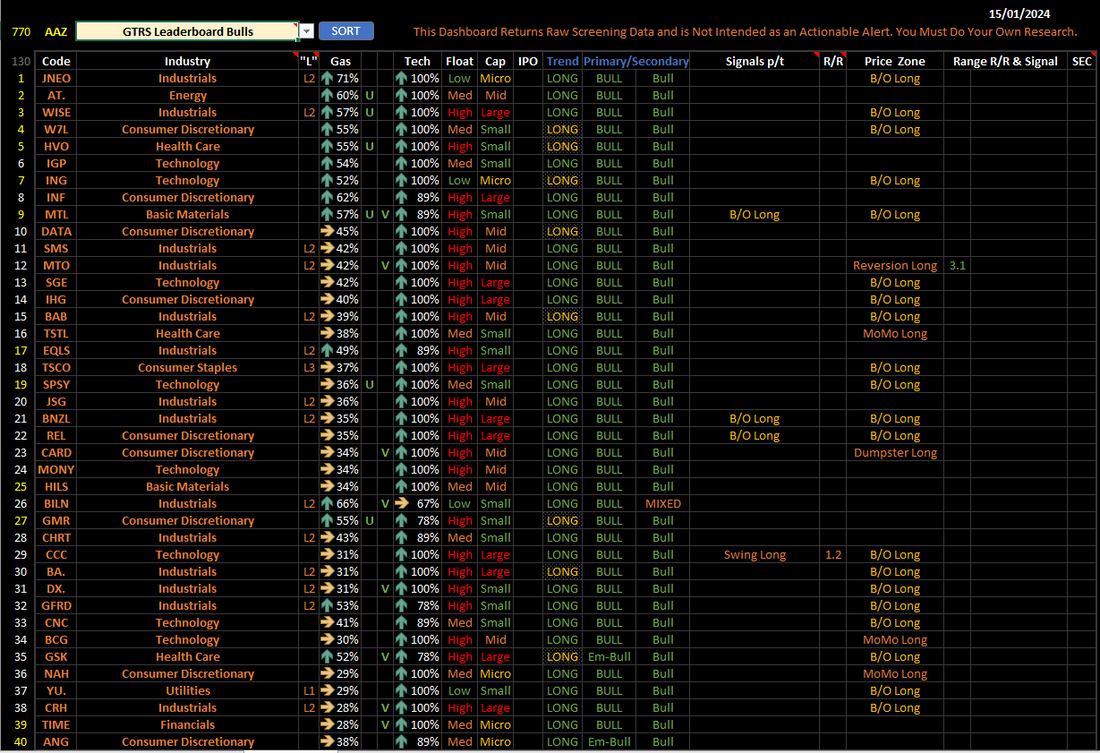

The GTRS Leaderboard

Find out which stocks have the best growth characteristics right now! We drill down into the fundamentals that move stocks by screening the UK and US markets, looking for those that offer low-risk / high-reward opportunities. My main focus is on small caps for trend trades and on large caps for swing trades. The GTRS Leaderboard can screen stocks in any combination of value, growth, beta, cap, primary and secondary trend. It also highlights breakouts and pullbacks, so we know how the best stocks are acting and where opportunity can be found instantly. I do the work that many who have full time employment would struggle to find the time to do. This takes me about 4 hours a day to compile, come rain or shine.

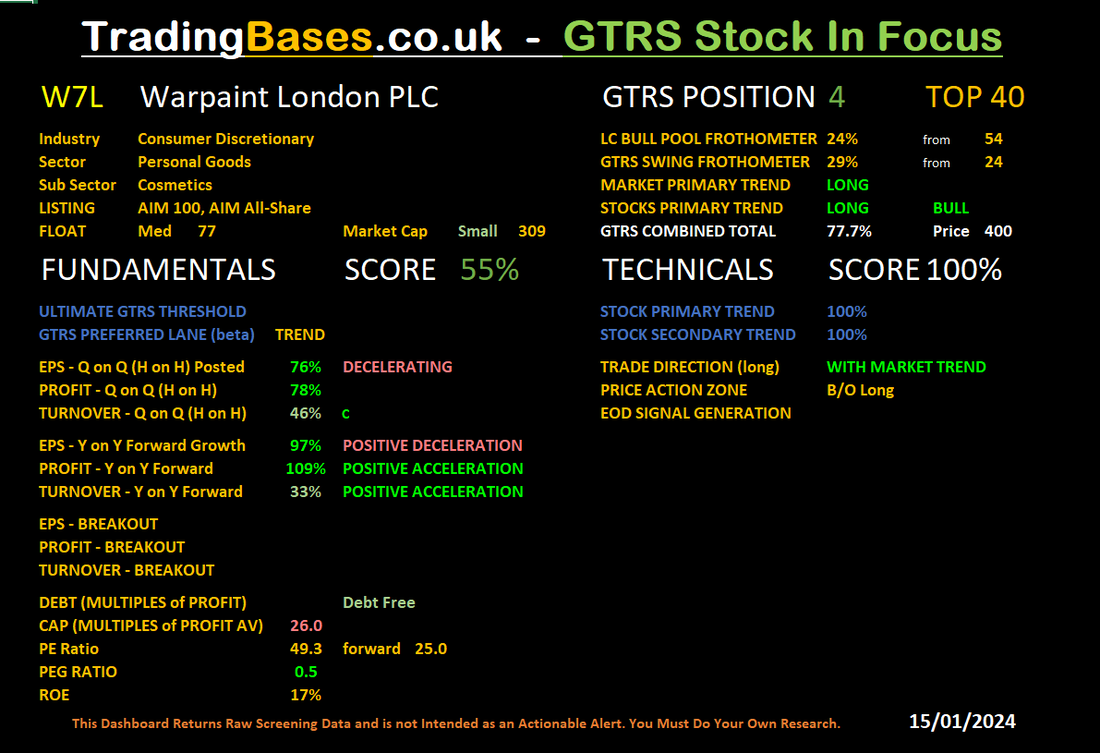

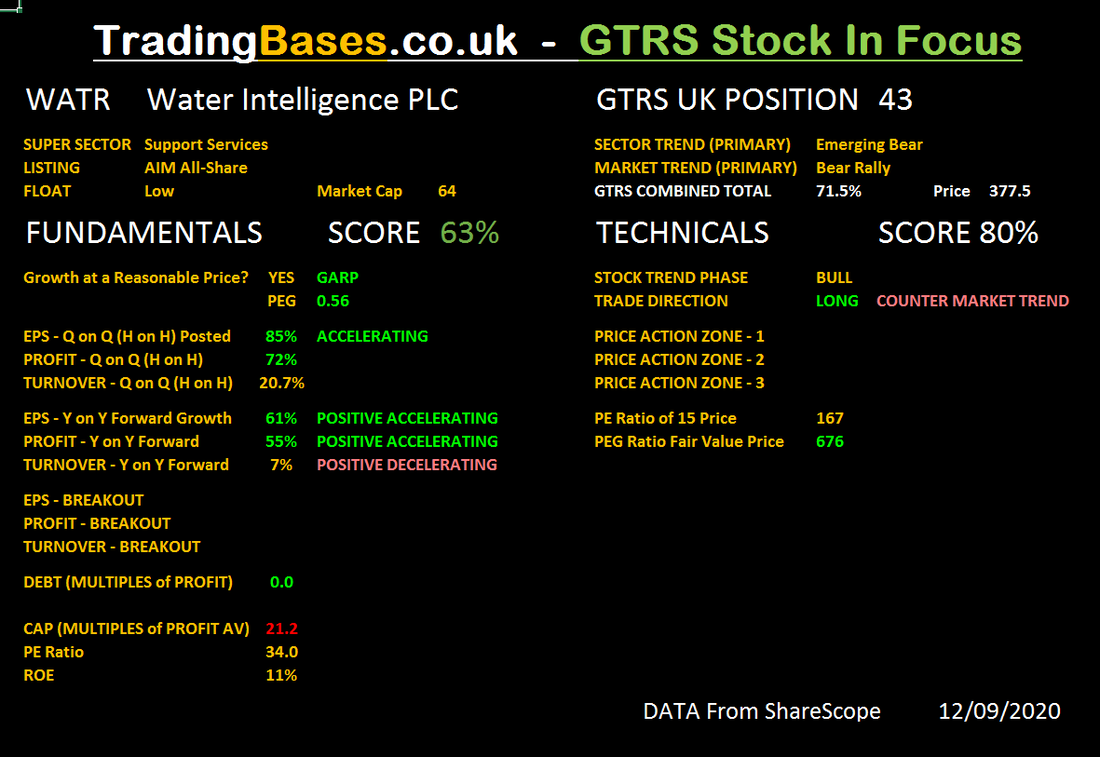

The Stock In Focus Dashboard

The Stock In Focus Dashboard was created as a cheat sheet, for quickly looking at the fundamental and technical breakdown of a stock and will highlight fundamental or technical criteria for further research. The recently updated dashboard now highlights reward to risk and position sizing brackets for my personal style, on a signal day such as a breakout. I also take a screen grab of the dashboard for the journal archive of stocks I like or have positions in. I can compare the changing fundamentals over time, as a stock moves through it's ever changing growth cycle.

The friendly chat group is a learning and idea sharing environment. I post the GTRS watch list, End of Day breakouts and reversals for both the US and UK markets in here. Topics are organised into channels and are easy to navigate. The group has many experienced traders and investors that have been helping new traders learn faster, both in the 'general chat' channel, and the dedicated 'members help channel'.